us germany tax treaty summary

Estate and Gift Tax. Aa the federal income taxes imposed by the Internal Revenue Code but excluding the accumulated earnings tax the personal holding company tax and social security taxes.

Global Tax Deal Reached Among G7 Nations The New York Times

Property to his or her German surviving spouse 50 of the value of the property is excluded from US.

. The official language of Germany is German and the currency is the euro EUR. Part of these conditions is however that the S. A In the United States.

Treaty Summaries is an up-to-date collection of summaries of every in-force US. Under US domestic tax laws a foreign person generally is subject to 30 US tax on a gross basis on certain types of US-source income. Convention between the United States of America and the Federal Republic of Germany for the Avoidance of Double Taxation and the Prevention of Fiscal Evasion with respect to Taxes on income and Capital and to Certain Other Taxes together with a related Protocol signed at Bonn on August 29 1989.

61 rows Summary of US tax treaty benefits. The vast majority of tax benefits you get from the USCanada tax treaty dont have to be claimed. Tax Rates on Income Other Than Personal Service Income Under Chapter 3 Internal Revenue Code and Income Tax Treaties Rev.

Most importantly for German investors in the United States the Protocol would eliminate the. United States and Germany Sign New Protocol to Income Tax Treaty SUMMARY On June 1 2006 the United States and Germany signed a protocol the Protocol to the income tax treaty between the two countries as amended by a prior protocol the Existing Treaty. Corporation can be deemed resident in the US.

It is divided into 16 provinces and its capital is Berlin. If you found yourself in one of those rare complicated situations that a specific article alleviates youd file Form 8833 and include your situation in the summary. The saving clause Art.

MAKING SENSE OF FOUR TRANSATLANTIC ESTATE TAX TREATIES. This table lists the income tax and withholding rates on income other than for personal service income including rates for interest dividends royalties pensions and annuities and social security payments. With tax playing an important role in the response to the coronavirus COVID-19 pandemic the OECD has outlined a range of tax measures governments could adopt to curb the economic fallout of the crisis and has developed a compilation of all tax measures taken by governments so far.

2 so-called participation exemption. Under the treaty if a German decedent bequeaths the US. The existing taxes to which this Convention shall apply are.

Individual Capital Gains Tax Rate. Corporate Income Tax Rate. For further information on tax treaties refer also to the Treasury Departments Tax Treaty Documents page.

The US-Russia Income Tax Convention in effect since 1994 was designed to address the issue of double taxation and fiscal evasion with respect to taxes on income and capital. Introduction The purpose of this paper is to present a summary of the principal rules for the allocation of estate taxes and the avoidance of double taxation under four of the most important estate tax treaties to which the. The summaries reflect the current in-force text of the treaties as amended by in-force.

1 4 DTC USA allows the USA to tax their own citizens regardless of the provisions of the DTC. Germany - US FATCA Treaty overview. The lower rates on dividends apply under certain conditions minimum shareholding specific shareholders in some cases minimum holding period.

The complete texts of the following tax treaty documents are available in Adobe PDF format. Definition of USCanada Tax Treaty. The Text shows the Convention between the United States of America and the Federal Republic of Germany for the Avoidance of Double Taxation with Respect to Taxes on Estates Inheritances and Gifts as amended by the Protocol to the German American Treaty generally referred to as the Germany-US.

23 5 DTC USA. The United States Germany Tax Treaty covers double taxation with regards to income tax corporation tax and capital gains tax. Corporate Capital Gains Tax Rate.

The Protocol signed at Berlin on June 1 2006 amended Article 26 of the Tax Treaty between the United States of America and the Federal Republic of Germany for the Avoidance of Double Taxation and the Prevention of. In most cases the US will credit the German tax against the US tax Art. In other words a Canadian citizen who is living in the US for a work placement wont need to face double taxation.

Initially formed in the year of 1980 this mutual taxation agreement limits the duties between Canadian and US citizens and permanent residents that live in on the other side of the border. If you have problems opening the pdf document or viewing pages download the latest version of Adobe Acrobat Reader. Before you run out and.

Estate and Gift Tax Treaty. For most types of income the solution set out in the Treaty for US expats to avoid double taxation in Germany is that they can claim US tax credits against German taxes that theyve paid on their income. Germany is a key member of the European economic political and defence organisations.

The tax authorities can order a WHT of 15825 including solidarity surcharge if ultimate collection of the tax due is in doubt. Income tax treaty that serves as a quick reference guide to the US. How to claim USCanada income tax treaty benefits.

Germany - Tax Treaty Documents. The purpose of the USGermany Tax Treaty is to help Taxpayers determine what their tax liability is for certain sources of taxable income involving parties to the treaty. Both forms of tax are reduced by treaty relief.

US-France US-Germany US-Netherlands and US-United Kingdom by Michael W. Updated guidance on tax treaties and the impact of the COVID. And bb the excise tax imposed on insurance premiums paid.

While the US Germany Tax treaty is not the final word on how items of income will be taxed it does help Taxpayers better understand how either the US Government andor Germany will tax certain sources of income. US persons making payments withholding agents to foreign persons generally must withhold 30 of payments such as dividends interest and royalties made to foreign persons. Tax treaty network and provides an at-a-glance overview of the important provisions of each treaty.

Convention between the United States of America and the Federal Republic of Germany for the Avoidance of Double Taxation and the Prevention of Fiscal Evasion with respect to Taxes on income and Capital and to Certain Other Taxes together with a related Protocol signed at Bonn on August 29 1989. Germany has the largest economy and is the second most populous nation after Russia in Europe. The tax treaty provides that withholding taxation of dividends shall not exceed 5 percent under certain.

In addition to this 50 exclusion the German decedents estate would receive a deduction of up to 117000000 for deaths occurring in 2021 on the remaining value of the US. This means that a US citizen who lives in Germany will be taxed in Germany because of tax residence and in the US because of citizenship.

The Us Uk Tax Treaty Explained H R Block

The War In The Pacific Reading Worksheet Student Handouts History Worksheets High School American History World History Teaching

Eu Us Relations In Search Of Common Ground Euractiv Com

Should The United States Terminate Its Tax Treaty With Russia

Doing Business In The United States Federal Tax Issues Pwc

Luxembourg Tax Treaty International Tax Treaties Compliance Freeman Law

Should The United States Terminate Its Tax Treaty With Russia

What Is The U S Germany Income Tax Treaty Becker International Law

Why Is The Us Fixated On China S Rise In Africa Quartz Africa

International Corporate Tax Reform Dgap

Should America Still Police The World The New Yorker

The Longer Telegram Toward A New American China Strategy Atlantic Council

New Us Hong Kong Tax Treaty Suspension Sends Important Signal Despite The Costs Atlantic Council

United States Germany Income Tax Treaty Sf Tax Counsel

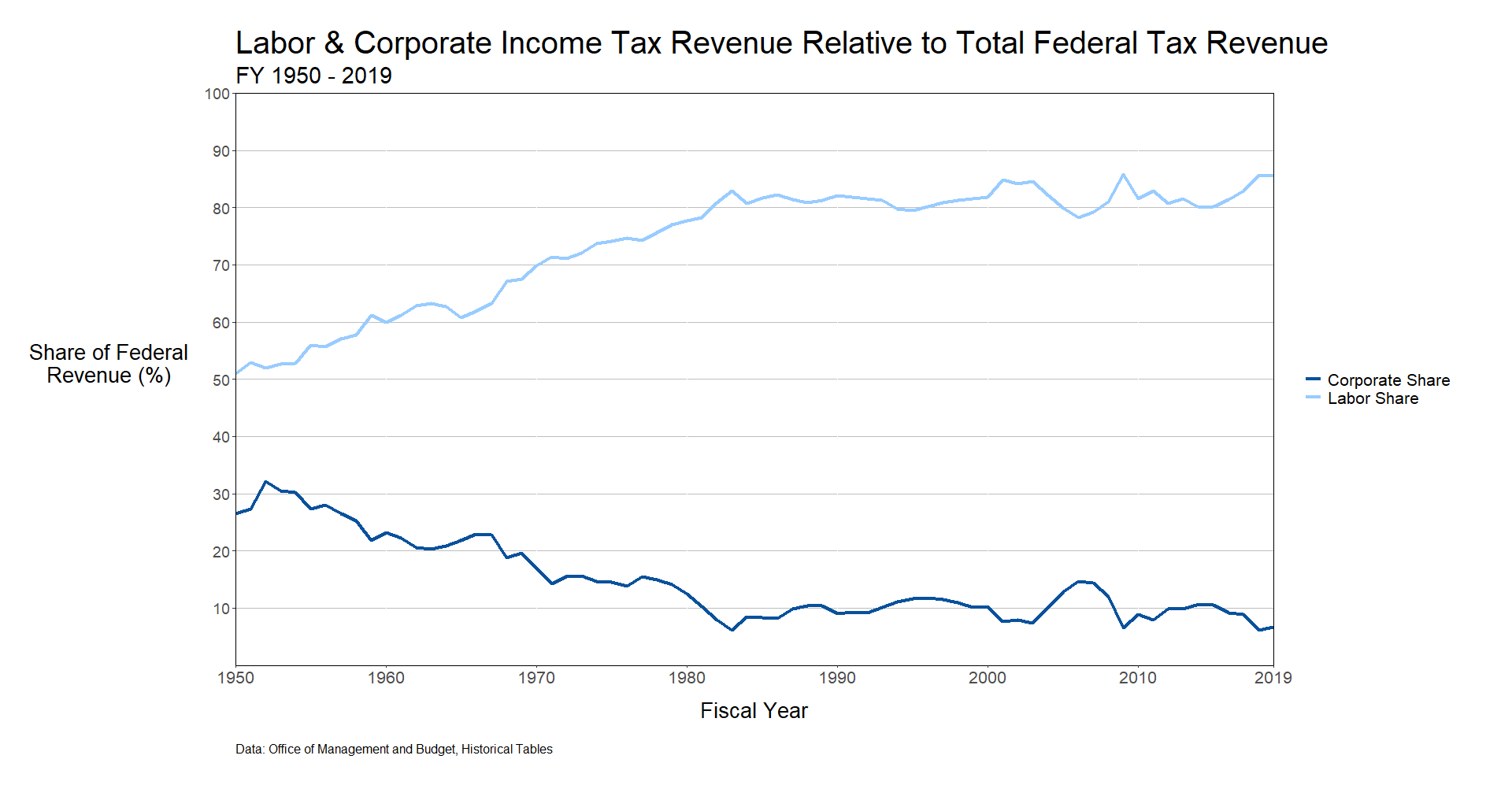

Why The United States Needs A 21 Minimum Tax On Corporate Foreign Earnings U S Department Of The Treasury